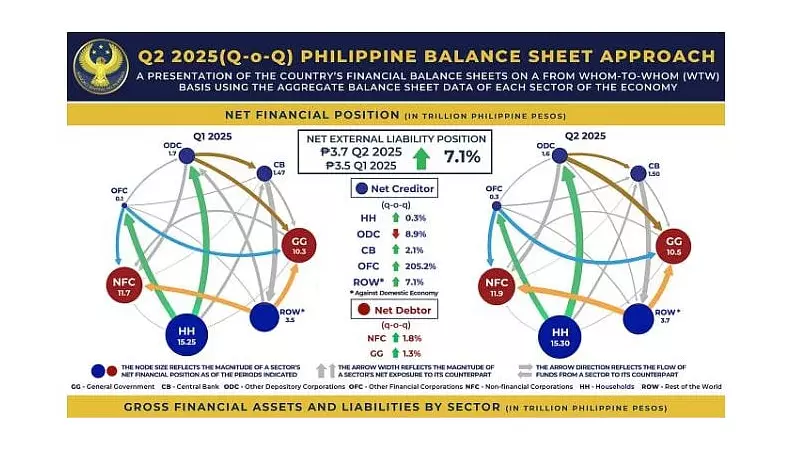

Preliminary data from the Balance Sheet Approach (BSA) reveals a significant increase in the Philippines' financial obligations to the rest of the world during the second quarter of 2025. The nation's net external liabilities climbed by 7.1 percent, from P3.5 trillion in the first quarter to P3.7 trillion by the end of June 2025.

Key Drivers Behind the Growing Debt

This expansion in the domestic economy's net liabilities was primarily fueled by two major sectors. Non-financial corporations sought more external financing, particularly through equity and investment fund shares. Simultaneously, the general government increased its borrowing from foreign lenders. An additional factor was a decline in the central bank's holdings of debt securities issued by nonresidents, which also contributed to the overall net liability position.

Corporate Sector Reliance on External Funding

The net debtor position of non-financial corporations widened notably. This was due to a rise in equity security liabilities owed to nonresidents and other financial corporations. For this sector, loans remained the primary funding instrument, closely followed by equity securities. Nearly three-fourths of the sector's total outstanding liabilities were sourced from the rest of the world and other depository corporations, highlighting a strong dependence on external finance.

Government Debt and Currency Insulation

The general government also saw its net debtor position expand. This growth reflected increased holdings of government securities by other depository corporations, non-residents, and other financial corporations. Furthermore, loans owed by the government to nonresidents grew. Government securities stayed as the sector's main funding tool. A crucial point of resilience is that 70.1 percent of the general government's obligations are denominated in Philippine pesos. This substantial domestic currency share provides a partial buffer against the volatility of foreign exchange rate fluctuations.

Implications and Economic Monitoring

The Balance Sheet Approach, a financial stability surveillance tool developed by the International Monetary Fund in 2002, is critical for this analysis. Unlike traditional methods that track economic flows over time, the BSA examines the outstanding stock of financial assets and liabilities at a specific point. This snapshot, dated December 30, 2025, helps regulators monitor potential vulnerabilities within different economic sectors and their interconnections. The rising external liabilities underscore the importance of monitoring debt sustainability and the country's exposure to global financial shifts.