Metropolitan Cebu Water District in Financial Turmoil: P765 Million Lost in 2025

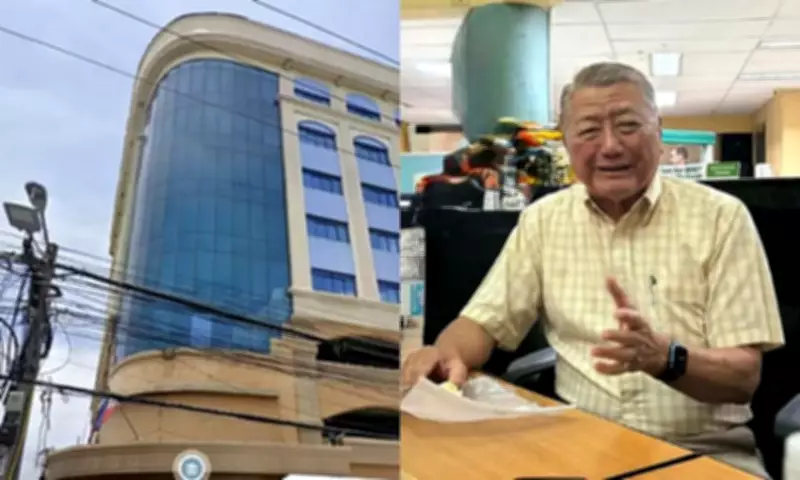

The Metropolitan Cebu Water District (MCWD), which supplies water to Cebu City and most of Metro Cebu, is grappling with severe financial distress. According to newly installed board chairman Ruben Almendras, the water district has been "losing immensely" and operating on a "negative cash flow" since at least early 2026. Almendras disclosed to News+One on January 12, 2026, that MCWD has "no gross margin as revenue is less than cost of water," painting a grim picture of its fiscal health.

Staggering Loss Figures and Daily Waste

Specific figures revealed by Almendras during an assembly of City Hall officials on February 2, 2026, and confirmed by City Mayor Nestor Archival Sr. at a press conference the following day, show that MCWD lost P765 million in 2025. Additionally, the water district wastes P6.5 million daily on non-revenue water (NRW), which includes unattended pipe leaks and possible unbilled water. This financial hemorrhage is compounded by a production cost that far exceeds income from consumer sales.

To illustrate the imbalance, MCWD buys water at P35.70 per cubic meter but sells it to consumers at only P1.03 per cubic meter. Earlier reports indicated even higher production costs, ranging from P42 to P43 per cubic meter, when other expenses are factored in. This unsustainable model has led to a negative cash flow of P342 million in 2025, forcing consumers to pay more starting May under rates approved by the Local Water Utilities Administration (LWUA). However, further increases may be necessary to restore profitability.

Almendras' Recovery Plan and Solvency Assurance

Despite the bleak financial news, Almendras offers a glimmer of hope. He asserts that MCWD remains "solvent," with assets totaling P3.2 billion exceeding liabilities. The board chairman is resolved to make the company profitable again by 2027 through strategic measures. Key initiatives include renegotiating selling prices with bulk water suppliers and aggressively reducing the rate of non-revenue water.

Almendras emphasized rationalizing bulk water supply by optimizing volume, price, and direction to "optimize revenue" and reduce the weighted average cost of water. This involves maximizing low-cost MCWD production from surface and well water while minimizing purchases from private suppliers. The board plans to review each purchase contract to assess "price justification" and direct costly desalination water to high-priced customers, such as MEPZ companies, where higher charges can be applied.

Unresolved Allegations and Political Dynamics

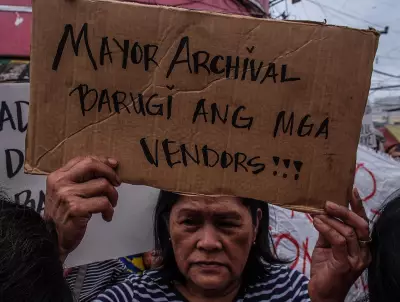

The financial crisis is further complicated by unresolved allegations from Vice Mayor Tomas Osmeña, who in August 2025 accused MCWD of "mismanagement and anomalies." Osmeña called for LWUA intervention, citing a "very serious situation" threatening Metro Cebu's water supply, though he did not provide specific evidence at the time. He expressed a desire to be designated as the city's "water czar" to oversee water concerns.

However, since returning from medical leave in the U.S. in January 2026, Osmeña has not publicly addressed MCWD's issues, focusing instead on other local matters like the Carbon public market controversy. This silence raises questions about the status of his earlier allegations and whether he will pursue action against those responsible for the water district's woes.

Investigations and Corruption Concerns

When asked about potential collusion or fraud in bulk water pricing, Almendras acknowledged "rumors of kickbacks on bulk water supply contracts and pipe-laying projects" but noted that evidence is hard to obtain due to cash transactions. He indicated that investigations by police or the National Bureau of Investigation (NBI) might occur "in due time," similar to past probes into city overpayments.

The public remains largely unaware of the full extent of MCWD's financial state, as highlighted by Almendras' disclosures. With a recovery plan in motion and ongoing scrutiny, the water district's path to profitability by 2027 will depend on effective implementation and transparency in addressing both financial and governance challenges.