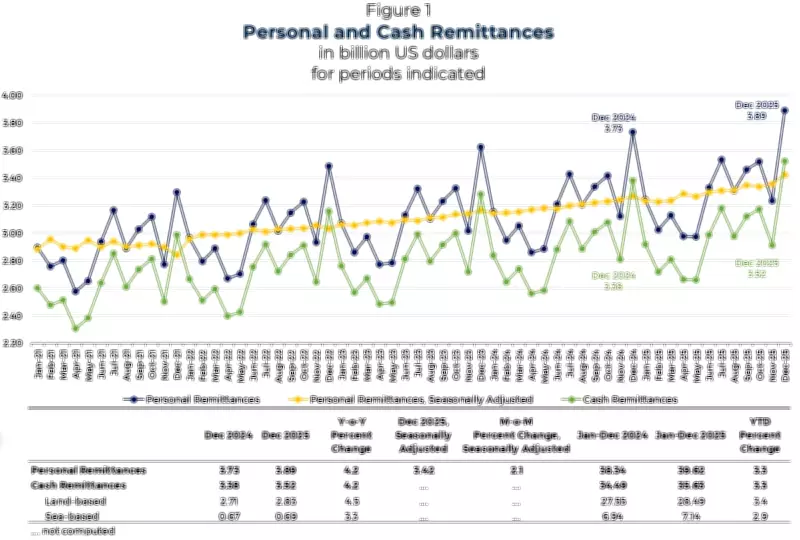

Overseas Filipinos Drive Record $35.63 Billion in Remittances for 2025

Overseas Filipinos achieved a historic milestone in 2025, sending home a record-breaking $35.63 billion in cash remittances over the full year. This figure represents a significant 3.3 percent increase from the $34.49 billion recorded in 2024, underscoring the steady growth and resilience of this vital economic lifeline. The momentum peaked in December 2025, with cash remittances soaring to $3.52 billion, marking a 4.2 percent rise compared to the same month in the previous year. This surge reflects heightened holiday transfers as migrant workers bolstered support for their families during the festive season. On a seasonally adjusted basis, cash remittances in December increased by 2.1 percent from November, highlighting a consistent upward trend.

Economic Impact and Key Contributors

Remittances played a crucial role in the Philippine economy in 2025, accounting for 7.3 percent of the gross domestic product and 6.4 percent of the gross national income. These inflows serve as a stabilizing pillar for household consumption, helping to buffer against inflation and external shocks. Families typically spend these funds quickly on essentials such as food, tuition, and housing, thereby supporting robust domestic demand. In addition to cash remittances, personal remittances—which include cash transfers, in-kind support, and money sent through both formal and informal channels—also reached new heights. Personal remittances climbed to $3.89 billion in December, up 4.2 percent year on year, with the annual total hitting $39.62 billion, a 3.3 percent increase from $38.34 billion in 2024.

The United States remained the largest source of cash remittances in 2025, contributing 39.7 percent of the total. Following the US, Singapore accounted for 7.3 percent, and Saudi Arabia made up 6.6 percent. Other significant contributors included Japan at 5.0 percent, the United Kingdom and the United Arab Emirates each at 4.6 percent, Canada at 3.5 percent, Qatar at 2.9 percent, Taiwan at 2.8 percent, and Hong Kong at 2.5 percent. Combined transfers from other countries comprised 20.6 percent of the total, showcasing the diverse geographic spread of overseas Filipino workers.

Breakdown by Worker Type and Monthly Trends

Land-based workers continued to drive the bulk of remittance inflows, with the United States accounting for 41.6 percent of their contributions. Saudi Arabia followed with 8.2 percent, Singapore with 6.5 percent, the UAE with 5.7 percent, and Japan with 4.5 percent. Other countries together contributed 33.6 percent. In contrast, sea-based workers exhibited a different geographic pattern. While the United States still led with 32.2 percent, Singapore ranked second at 10.3 percent, followed by Japan at 7.1 percent, and the United Kingdom and Germany each at 5.4 percent. Other sources comprised 39.6 percent of sea-based remittances.

Monthly data over the past two years reveal a gradual rise in remittance inflows, with seasonal spikes typically occurring in December. This pattern aligns with year-end bonuses and holiday-related support sent by overseas workers to their relatives back home. Economists emphasize that remittances act as a critical buffer, enabling families to maintain consumption levels despite global uncertainties. The latest figures suggest that overseas Filipinos maintained steady earnings and prioritized financial support for their loved ones, sustaining one of the Philippines' most reliable sources of foreign exchange. This consistent flow highlights the enduring commitment of migrant workers to their families and the broader economy.